Page 19 - Sample_An_Pham_Ho_So_VNR500_2019

P. 19

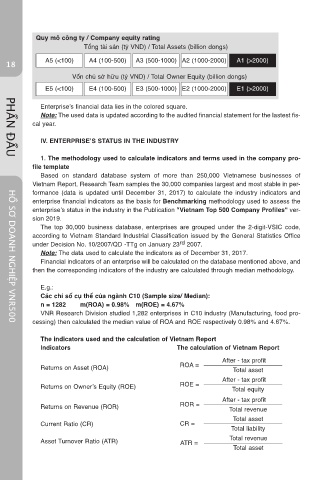

Quy mô công ty / Company equity rating

Tổng tài sản (tỷ Vnd) / Total assets (billion dongs)

18 a5 (<100) a4 (100-500) a3 (500-1000) a2 (1000-2000) a1 (>2000)

Vốn chủ sở hữu (tỷ Vnd) / Total owner Equity (billion dongs)

E5 (<100) E4 (100-500) E3 (500-1000) E2 (1000-2000) E1 (>2000)

Enterprise’s financial data lies in the colored square.

Note: The used data is updated according to the audited financial statement for the lastest fis-

cal year.

iV. enteRpRise’s statUs in the inDUstRy

1. the methodology used to calculate indicators and terms used in the company pro-

PHẦN ĐẦU

file template

Based on standard database system of more than 250,000 Vietnamese businesses of

Vietnam Report, Research Team samples the 30,000 companies largest and most stable in per-

formance (data is updated until december 31, 2017) to calculate the industry indicators and

enterprise financial indicators as the basis for Benchmarking methodology used to assess the

enterprise’s status in the industry in the publication "Vietnam top 500 Company profiles" ver-

sion 2019.

The top 30,000 business database, enterprises are grouped under the 2-digit-VsiC code,

according to Vietnam standard industrial Classification issued by the General statistics office

under decision no. 10/2007/Qd -TTg on January 23 rd 2007.

Note: The data used to calculate the indicators as of december 31, 2017.

Financial indicators of an enterprise will be calculated on the database mentioned above, and

then the corresponding indicators of the industry are calculated through median methodology.

E.g.:

Các chỉ số cụ thể của ngành C10 (sample size/ median):

n = 1282 m(Roa) = 0.98% m(Roe) = 4.67%

VnR Research division studied 1,282 enterprises in C10 industry (manufacturing, food pro-

cessing) then calculated the median value of Roa and RoE respectively 0.98% and 4.67%.

HỒ SƠ DOANH NGHIỆP VNR500

the indicators used and the calculation of Vietnam Report

indicators the calculation of Vietnam Report

after - tax profit

Roa =

Returns on asset (Roa) Total asset

after - tax profit

Returns on owner’s Equity (RoE) RoE =

Total equity

after - tax profit

Returns on Revenue (RoR) RoR =

Total revenue

Total asset

Current Ratio (CR) CR =

Total liability

Total revenue

asset Turnover Ratio (aTR) aTR =

Total asset